What About the Pricing Strategies for Gold, Silver, and Other Precious Metals?

If you’re a local pawn shop business in North Carolina like Parker Pawn and Jewelry, you know how important it is in today’s world to make sure you are up to date on silver, gold, and other precious metals market prices.

This article will discuss the difference between cost-based and demand-based pricing strategies, setting prices, and optimizing profit while keeping our customer’s costs low and fair value.

When determining value and pricing, one important factor is understanding how the market and demand for gold and precious metals act.

Cost-based pricing strategy

Cost-based pricing is a pricing strategy based on the cost of production, manufacturing, and distribution of a product- in this case, gold and silver. In other words, the selling price of a product has a percentage of the manufacturing cost included to ensure profit.

An example of this would be a cellphone manufacturer spending USD 800 making a cellphone, and the selling price is cost plus 10%; why? Because the manufacturer would need to cover manufacturing costs and still make a profit. They would sell that phone to a distributor for USD 880.

Cost-plus pricing strategy

Cost-plus pricing is a standard method that uses the total cost of goods sold as the primary basis for pricing. It is a simple strategy where the seller decides how much extra is included in the product’s price that will be simply profit.

For example, you want to sell a cell phone, and you add 10% more than the actual cost the manufacturer charged you. The price you set is 110% of the actual cost charged by the manufacturer.

Demand-based pricing strategy

Demand-based prices are sometimes referred to as customer-based pricing. Demand-based pricing is a strategy where the seller adjusts the product’s price, often in real-time, according to customer demands and perceived/determined value. Demand-based pricing is an umbrella term that consists of multiple types of pricing strategies.

For example, if snow boots sell well in the winter, the seller may adjust the price to make more on the sale of the snow boots while the demand is high. The seller may decrease the price when summer rolls around, knowing not many customers will pay high costs for the boots because they aren’t a high-demand item.

Geo-based pricing strategy

Companies use this type of demand-based pricing for advertisement and promotional activities where the pricing is based solely on the consumer’s geographical location. In high-wage areas such as New York or L.A, consumers from that area may experience a higher price than consumers shopping online from a rural area.

It can also be the opposite if the demand for an item that is considered a rarity in a rural area comes available. The increase in price in select regions is based on supply and demand.

Price skimming pricing strategy

Price skimming is a product pricing strategy that involves pricing a product at a high value after it’s first launched. The assumption is the product will be in high demand as a “new shiny object” and a must-have. Over time the pricing may lower. This method of demand-based pricing helps companies initially recover their costs with the help of early adopters. Then, when lowering the price over time, they can cover a larger market share.

Yield management pricing strategy

This method, also known as the revenue management system, is used by sellers of perishable or fixed goods, such as hotel rooms and airline seats. Offering the correct item to the right customers for the right price, yield management is making frequent adjustments to the price of a product in correspondence to demand and competition.

For example, if a conference in a city advertises a nationally renowned keynote speaker, attendees will need hotel rooms to stay in while they attend the conference. Room rates may be adjusted with the demand, offering the rooms for more than the average cost per room or at lower prices to get most of the bookings.

Determining value and profitability optimization of precious metals

So how do we take the information we’ve learned and apply it to pricing and purchasing precious metals?

As a business, you want to gather as much data about your retail pricing across the web and your competitor’s pricing to set a strategy that reaches a broader market.

Parker Pawn and Jewelry

Parker Pawn wants to buy, sell, and loan on all gold, silver, and precious metals. To meet the broader market’s needs, the store team reviews the spot price of all the precious metals daily. The current value of gold is always publicly available.

We buy gold and silver at all three of our locations. With a certified goldsmith on staff, we can appraise the value of the precious metals you want to sell to us or get a loan against. All consultations are free.

Important to know is the value of gold is based on its purity. In the simplest of terms, think of 24K gold and look at it as a pizza that has been cut into 24 equal pieces. You are left with 22K gold if you take two pieces away, and if you take six parts away, you are left with 18K gold.

We offer the most % on spot price (market price) plus a premium. The premium is an additional fee to ensure that the costs of doing business are covered and would be the equivalent of cost-based pricing strategies.

The spot price is based on supply and demand in the market, and Parker Pawn doesn’t have a say in this price. The adjustment has to happen to add premium charges to cover overhead. No deal is too big for Parker Pawn, and the service provided is for the customers.

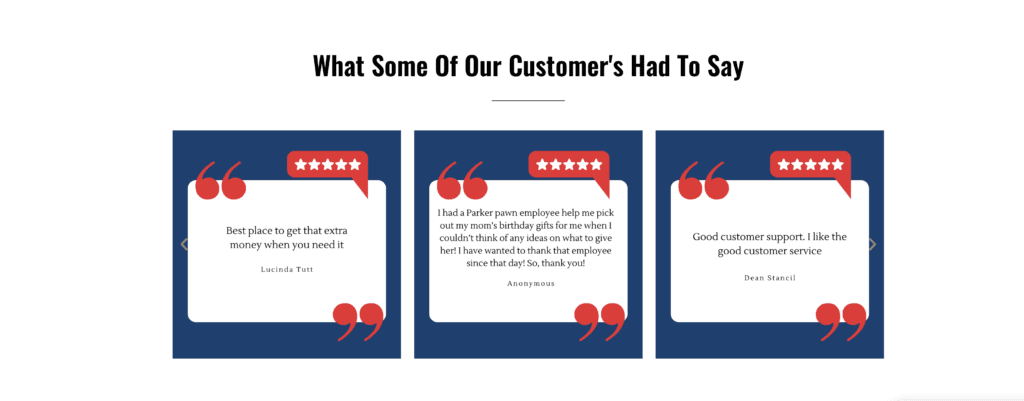

Located near Ft. Bragg in Fayetteville, NC, Parker Pawn is a wonderful pawn and jewelry shop with many happy reviews and satisfied customers. We have been a family-owned business since 1955 and have three conveniently located stores. We are North Carolina’s #1 pawn and gold company!

Offering the best prices on gold, diamonds, and jewelry, we are happy to help you purchase a product at lower prices than our competition. Plus, we have an easy-to-navigate website ensure that buyers see all there is at each store with no hassle.

Like all businesses, we have to make a profit if we stay in business. Our premiums on precious metals are reasonable, and we make sure each customer pays a fair price. We are not into raising prices due to geographic location like geo pricing or raising prices like skimming prices.

We provide pawn services and help our customers looking for a fast and easy way and affordable means to buy, sell, or pawn their valuable items.

We offer free appraisal services. Our loan services are available 24/7, and you can check us out on Facebook to see what events and sales we are advertising. Our website covers the questions you may have, and there are links to our pages that explain how to buy, sell, and loan jewelry, gold, silver, precious metals, luxury handbags, musical instruments, name brand tools, and Rolex watches. Visiting our website often and looking at specific pages will keep you informed of all current sales, discounts, or events and let you know what we have in our online store.